estate tax changes effective date

This provision is effective for tax years beginning January 1 2022. 2 increases the top capital gains rate from 20 percent to 25 percent for top marginal income tax brackets starting at 400000 for single filers.

Income Tax Law Changes What Advisors Need To Know

Increase in Capital Gains Taxes effective as of September 13 2021.

. Residents may call their County Tax Board for more information. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion.

The effective dates of the newly enacted provisions generally are expected to be Jan. Changes to the Estate and Gift Tax Laws Still Pending Published on. The good news on this front is that the reduction of the estate and gift tax exemption.

The effective dates of the newly enacted provisions generally are. January 1 2022 EstateGift Tax Exemption Cut in Half. The proposal includes an increase in the highest capital gains tax rate from 20 to 25.

Generally speaking non-grantor trusts and estates are separate taxpayers. October 20 2021 by David G. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026.

The proposal seeks to accelerate that. Under present law this can be accomplished income tax free. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax. The effective date of these tax rates and the tax bracket is January 1 2022. That is the gift tax exemption was 1 million and the estate tax.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. However the change to the top capital gains rate which is increased to 25 is effective. Wealthy individuals who delay estate planning until.

Hardin It has been our hope that estate and gift tax reform would be settled. Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

Increase income taxeseffective January 1 2022. The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. 1 2022 but certain provisions may have proposed effective dates tied to the date of.

However the proposed effective date for almost everything else. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

The effective dates of the newly enacted provisions generally are expected to be Jan.

How The Tcja Tax Law Affects Your Personal Finances

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

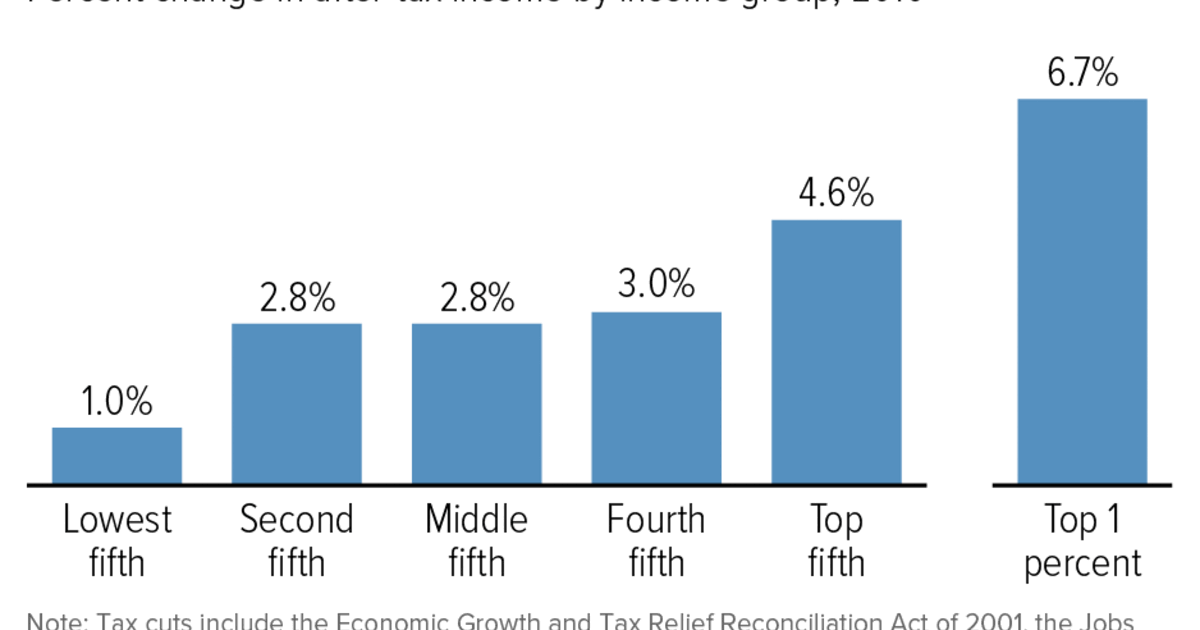

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets Tax Foundation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Estate Tax Law Changes What To Do Now

How Do Taxes Affect Income Inequality Tax Policy Center

The Generation Skipping Transfer Tax A Quick Guide

How Could We Reform The Estate Tax Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How The Tcja Tax Law Affects Your Personal Finances

How Could We Reform The Estate Tax Tax Policy Center

What You Need To Know About The 11 Million Estate Tax Exemption Going Away